The FIFO system helps businesses with managing inventory by ensuring that the oldest products are sold or used first. This reduces the risk of having to dispose of outdated products and minimizes inventory spoilage. This is essential for businesses that sell products with expiration dates, such as food and beverages. By selling the oldest items first, businesses can ensure that their customers are receiving fresh and usable products. But it also helps any business avoid carrying obsolete products and losing profits as a result.

May Not Reflect Inventory Flow

- The FIFO inventory system is also important for businesses that are subject to International Financial Reporting Standards (IFRS).

- You now have zero pencils remaining from the first shipment and 400 pencils from the second shipment in the warehouse.

- Inventory that is purchased first is sold or used in production before inventory that is purchased at a later date.

- The company sells an additional 50 items with this remaining inventory of 140 units.

- LIFO is a different valuation method that is only legally used by U.S.-based businesses.

Retailers often deal with products that have a limited shelf life or are subject to seasonal trends. By using FIFO, retailers can ensure that older stock is sold first, maintaining product freshness and minimizing waste. FIFO can lead to an improved inventory turnover rate, as it encourages the movement of older stock first. This reduces the likelihood of inventory sitting idle, tying up capital, and incurring holding costs.

What Is the FIFO Method?

Businesses must consider various factors, from selecting the right software solutions to training employees and maintaining accurate records. This section provides a detailed guide on best practices for implementing FIFO, common mistakes to avoid, and how to leverage technology to facilitate the process. By following these guidelines, businesses can ensure a smooth transition to FIFO and reap the benefits how to invoice as a contractor of this efficient inventory valuation method. Implementing FIFO can be streamlined with the use of specialized inventory management software. These solutions automate the tracking of inventory purchases and sales, ensuring accurate and efficient implementation of FIFO. Features to look for include real-time inventory tracking, automated cost calculations, and integration with accounting systems.

Why is FIFO the best method?

It can be easy to lose track of inventory, so adopt a practice of recording each order the day it arrives. This makes it easier to accurately account for your inventory and maintain proper FIFO calculations. Sal’s Sunglasses is a sunglass retailer preparing to calculate the cost of goods sold for the previous year. We’ll explore how the FIFO method works, as well as the advantages and disadvantages of using FIFO calculations for accounting. We’ll also compare the FIFO and LIFO methods to help you choose the right fit for your small business. Warehouse management refers to handling inventory and similar tasks within a warehouse environment.

On the other hand, if the warehouse is storing non-perishable products without expiration dates, either system could potentially be used depending on the specific needs of the business. This method assumes that the most recently purchased products should be sold first. This can result in a lower cost of goods sold but a higher inventory value, which can have negative tax implications.

FIFO Inventory Method

To avoid higher tax payments companies may purchase large quantities of inventory to match against their revenues. This can lead to businesses adopting poor buying habits under the LIFO method. FIFO, like any other inventory pricing or accounting method is based on contemporary rates of inflation. FIFO is software compatible, with most accounting software designed specifically for the FIFO method of accounting for inventory which is also easy to use and apply.

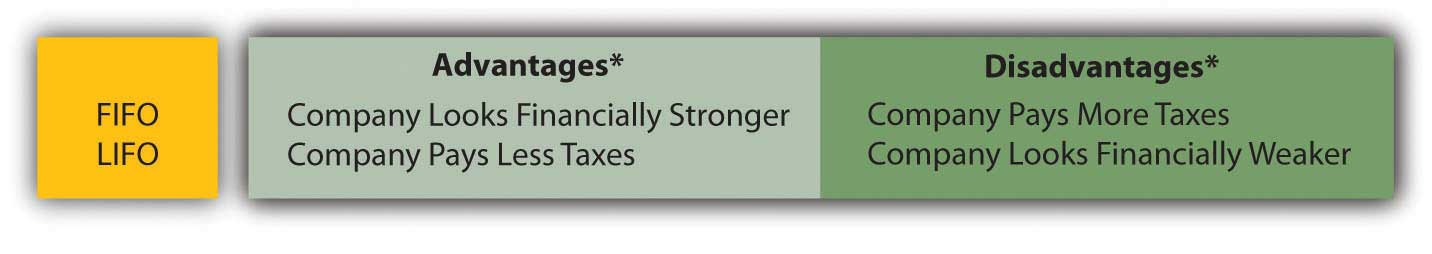

Alternative methods include LIFO, Weighted Average Cost, Specific Identification, and Standard Costing. LIFO assumes the newest inventory is sold first, resulting in a higher cost of goods sold during inflation. Specific Identification tracks individual item costs, while Standard Costing uses predetermined values while adjusting for variances over time. FIFO has advantages and disadvantages compared to other inventory methods.

If these products are perishable, become irrelevant, or otherwise change in value, FIFO may not be an accurate reflection of the ending inventory value that the company actually holds in stock. Along with the best practices, come a series of common mistakes we caution you to avoid. Firstly, ignoring stock rotation can result in older inventory being overlooked. And lastly, overlooking software capabilities can hinder FIFO implementation. Businesses should fully utilize the features of inventory management software.

For most businesses, it is the right choice because it provides such a range of benefits. The FIFO method’s logical approach to inventory flow makes cost tracking and calculation easier. This simplicity reduces accounting errors, speeds up month-end closings, and streamlines audits.

FIFO leaves the newer, more expensive inventory in a rising-price environment, on the balance sheet. As a result, FIFO can increase net income because inventory that might be several years old–which was acquired for a lower cost–is used to value COGS. However, the higher net income means the company would have a higher tax liability.